Hearing Rumors? Not sure your co-worker has it right?

Rumor Central has the answers! Submit your question or just browse our blog to separate facts from fiction.

Subscribe to Rumor Central

Subscribe to receive a monthly email that includes answers to recent Rumor Central questions.

Log in to myMOSERS. Click on My Contact Information, click the pencil icon next to Communication Preferences to edit. Check the checkbox next to Subscribe to Rumor Central.

-

Termination and Retirement Eligibility

Jun 26, 2025, 9:06 AM By MOSERSIf you get terminated from your job, are you still eligible for a retirement? How long do you have to wait till you can draw a retirement?If you are vested and leave state employment, you will still be eligible for a future pension benefit when you reach retirement age. A termination, whether voluntary or involuntary, marks the end of service accrual and impacts your MOSERS benefits.

Exceptions apply: You will forfeit all rights to a future pension benefit if you take a refund of your employee contributions (MSEP 2011 or Judicial Plan 2011) after leaving state employment or if you are convicted of a felony in connection with your duties as a state employee on or after August 28, 2014.

Retirement eligibility depends on your plan and is based on a combination of your age and service. Once MOSERS is notified of your termination, we will send you a letter outlining your eligibility for benefits.

Normal Retirement Eligibility Requirements:

- Age 65 + 5 years of service or

- Age 60 + 15 years of service or

- Rule of 80 – (at least age 48) when age + years of service = 80 or more

- Age 62 + 5 years of service or

- Rule of 80 – (at least age 48) when age + years of service = 80 or more at the time of termination

- Age 67 + 5 years of service or

- Rule of 90 – (at least age 55) when age + years of service = 90 or more at the time of termination

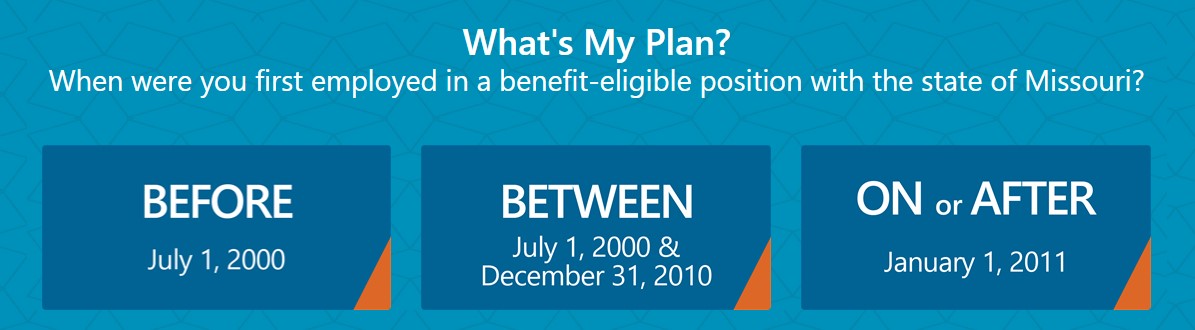

See the What’s My Plan? tool for information about plan membership, retirement eligibility requirements, and more!

-

Changing Jobs Before Vesting

Jan 31, 2025, 2:00 PM By MOSERSI currently work for Missouri State University, I will not be vested until 11/01/2026. I am thinking of applying for a job with Missouri Department of Economic Development, if I do I will start prior to my vested date with MSU, how would this affect my pension account?

Since you are already working in a MOSERS benefit-eligible position, you can transfer to any other MOSERS-covered employer in a benefit-eligible position, and your service credit will transfer with you, even if you are not yet vested. Once vested, you are eligible for a lifetime pension benefit when you also meet the retirement age requirement for your plan.If you are an MSEP 2011 member, your employee contributions will earn interest as long as you are actively employed, even if you transfer from one MOSERS-covered position to another.MOSERS administers retirement benefits (defined benefit pension and deferred compensation plans) for most benefit-eligible state employees. See our list of MOSERS Covered Employers to learn which state agencies and regional colleges & universities are covered by MOSERS, and the Benefit Providers table to find out who administers various benefits.

-

myMOSERS Account Security

Oct 25, 2024, 11:35 AM By MOSERSIs there a way to enable two-factor authentication (2FA) on the MOSERS website?To improve the security of your personal information, our new pension administration system requires multi-factor authentication (MFA) when you log in to myMOSERS. This means you will need to provide your password and an additional layer of verification, such as using an authenticator app or confirming your identity through a text message or email. Watch the myMOSERS Login Tutorial video to learn more about the new login process.

See the Get Ready for the New myMOSERS: Coming in April! article and visit the myMOSERS Help Center for more information about our secure online member portal.

-

How is the Benefit Formula Calculated?

Oct 24, 2024, 3:27 PM By MOSERSCan you please send information on how the retirement is calculated?For general state employees, MOSERS uses a three-part formula to calculate your monthly base benefit. This formula, as defined by law, includes the following factors:

- Final Average Pay (FAP) – The average of your highest 36 consecutive months of compensation.

- Multiplier – A number established by the legislature (1.6% or 0.016 for MSEP; 1.7% or 0.017 for MSEP 2000 and MSEP 2011).

- Credited Service – Your years and months of credited service earned, purchased, or transferred, and unused sick leave (if applicable).

Examples - Using the multiplier for MSEP 2000 or MSEP 2011 retirees:

$3,000 (FAP) x 0.017 (Multiplier) x 15 years (Credited Service) = $765 monthly base benefit

$3,500 (FAP) x 0.017 (Multiplier) x 17.5 years (Credited Service) = $1,041.25 monthly base benefit

$4,000 (FAP) x 0.017 (Multiplier) x 30 years (Credited Service) = $2,040 monthly base benefit

$_____ (FAP) x ____ (Multiplier) x ____ years (Credited Service) = $_______ monthly base benefit

*Base benefit is the amount before any reductions, taxes, or other deductions.

Learn more about the benefit formula breakdown in the Summary of Plan Benefits and by plan on our website: MSEP, MSEP 2000, and MSEP 2011.

You can also generate a benefit estimate by logging in to myMOSERS or contacting a MOSERS benefit counselor.

-

Which retirement plan do I fall under?

Sep 24, 2024, 8:53 AM By MOSERSI hired on in March of 2000. I cannot remember which retirement plan I fall under.

In general, if you were employed in a benefit-eligible position with the state of Missouri prior to July 1, 2000, and remained employed until vested in MSEP, then you are a member of MSEP. At retirement, you may elect to retire under MSEP or MSEP 2000.See the What’s My Plan? tool for information about plan membership, retirement eligibility requirements, and more!

-

MSEP 2011 & Purchasing Military Service

Jun 24, 2024, 10:49 AM By MOSERSI am interested in buying some of my military time and was wondering how that works?

Purchase of prior military service is not available to members of MSEP 2011 or the Judicial Plan 2011.

However, if you are called to or volunteer for active military duty while employed in a MOSERS-covered position, the Uniformed Services Employment and Reemployment Rights Act (USERRA) protects your employment and benefit rights, provided you meet the eligibility requirements. You may be eligible to receive credit for your active-duty service if you were employed by the state immediately before entering the armed forces, then return to state employment within the timeframe specified by USERRA and provide a copy of your honorable discharge and military DD214 (Member-4) and meet any other requirements under USERRA.

If you have additional questions, please refer to our Purchasing and Transferring Service Guide for MSEP 2011 Members or contact a MOSERS benefit counselor for more information.

-

New Employee Benefit Enrollment

Mar 25, 2024, 2:35 PM By MOSERSI am a new employee and I have set up my retirement. I have received one paycheck so far and my question is, is it too late to make changes? Do I need to wait for open enrollment?As a new employee with the state of Missouri, you should have received instructions to enroll in SEBES, the Statewide Employee Benefit Enrollment System. Visit www.sebes.mo.gov and log in with your SEBES password before the deadline, which is 31 days from your hire date. After the deadline, you must contact the appropriate benefit provider(s) directly to determine eligibility.

Once you are enrolled, you have access to a defined benefit pension, life insurance, and long-term disability benefits through MOSERS. We also have webinars available for new state employees who would like to learn more about their pension, life insurance, and long-term disability benefits. You can register via GoTo Webinar for a daytime webinar or evening webinar.

In addition to these benefits, you are automatically enrolled in the MO Deferred Comp plan at the minimum of 1% contribution per pay period. Your contribution can be adjusted at any time and is made through automatic payroll deductions. If you choose to opt out of the deferred compensation plan's auto-enrollment, you must do so by adjusting your contribution to zero within 30 days of your hire date. Employees who opt out within this time frame will receive a refund of any contributions they made to their MO Deferred Comp account. Please visit www.modeferredcomp.org for more information, or if you have any questions, please call (800) 392-0925.

-

MSEP 2011 and BackDROP

Aug 22, 2023, 2:01 PM By MOSERSWhy are MSEP 2011 employees not eligible for BackDROP?

All benefit provisions are outlined in law and MOSERS must administer benefits according to the law. In 2010, the Missouri General Assembly made changes to pension plans including the elimination of BackDROP for newer state employees. However, state employees retained the valuable defined benefit plan structure, which provides lifetime retirement benefits. BackDROP is available only to general state employees in MSEP and MSEP 2000. You can track proposed legislative changes on our Legislation page when the General Assembly is in session from January through mid-May.

-

Annual Benefit Statements

Feb 8, 2023, 7:56 AM By MOSERSWhen will the 2022 Annual Benefit Statements be available?

We send Annual Benefit Statements in March to all active members. You can access last year’s statement by logging in to myMOSERS, clicking on Documents, and selecting Document Express. It is available to print or save as a PDF. Once all 2023 statements are sent, we will send you an email and you will be able to access this year’s statement by logging in to myMOSERS. If you have opted to receive paper notifications, we will mail your statement to you. Please be sure your email address and mailing address is up to date with us!

Retirees get their Annual Benefit Statement each year on the anniversary of their retirement date or BackDROP date. We send benefit statements to elected officials and members on LTD in July, and we send statements to vested former state employees once every 5 years.

-

MSEP 2011 Seminars

Mar 4, 2022, 3:16 PM By MOSERSI am reaching out about the in-person retirement seminar for 2011 employees. At this time there are only 2, both in Jefferson City. Could there please be some added in other parts of the state? For anyone outside central Missouri this presents difficulties: such as myself it is a 5 hour drive one way. This means a VERY long day (4am-9pm) or missing 1/2 to 1 day work & the cost of a room.You are correct. For MSEP 2011 members we offer two in-person Ready to Retire seminars in Jefferson City. However, we also have two online webinars available this year on May 17th and September 20th. This is a great way to skip the commute and get important benefit information from your home.

You can visit our Ready to Retire page for more information and to learn how to register for a webinar.

Topics

- 1099-R (7)

- Annual Leave (2)

- BackDrop (8)

- COLA (9)

- Credited Service (5)

- Deferred Compensation (5)

- Early Retirement (1)

- Education (5)

- Employee Contributions (7)

- Final Average Pay (5)

- Former State Employee (3)

- Funding (4)

- Leaving State Employment (9)

- Legislation (5)

- Life Insurance (6)

- Long-term Disability (1)

- Medical Insurance (3)

- Military Service (4)

- MSEP (5)

- MSEP 2000 (5)

- MSEP 2011 (10)

- Normal Retirement (7)

- Payday (4)

- Re-employment (13)

- Retirement Process (8)

- Rule of 80 (3)

- Sick Leave (5)

- Social Security (2)

- Taxes (18)

- Temporary Benefit (3)

- Termination (2)

- Travel Assistance (2)

- Universities (3)

- Vesting (5)

Archive

Disclaimer

We strive to provide the most accurate information possible in our answers to Rumor Central questions. However, occasionally, laws, policies or provisions change and individual circumstances may vary. Please contact a MOSERS benefit counselor or see the handbooks in our website Library for more detailed information. If there is any difference between the information provided in this blog or on the MOSERS website and the law or policies that govern MOSERS, the law and policies will prevail. See our Privacy, Security & Legal Notices for more information.