Employer Contributions

Money to pay pension benefits comes from three sources: contributions from employers, contributions from employees, and investment earnings.

How do you calculate the amount employers pay?

Each year, the MOSERS Board certifies an employer contribution rate. Our external actuary calculates the rate based on investment, economic, and demographic assumptions. All the calculations go into our annual actuarial valuation. The actuary also conducts an experience study at least every five years, which compares current assumptions with the most recent actual data.

What is the current employer contribution rate for pension benefits?

See the retirement contributions chart for current employer contribution rates.

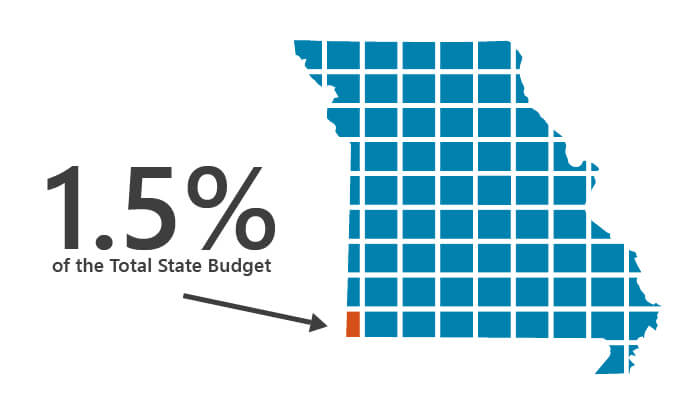

What percentage of the state budget goes to MOSERS?

The appropriation to MOSERS has remained less than 1.5% of the total state budget for decades. Employers have historically paid the full amount recommended by our external actuaries and certified by the MOSERS Board. This employer commitment is key to sustaining the retirement system.