FAQs - Termination and Reemployment

Below are questions and answers explaining MOSERS Board Rules on termination of employment and reemployment, which must include a “bona fide termination” with a 30-day separation of service.

1. Who does this affect?

The rules affect retirees of the Missouri State Employees Plan (MSEP, MSEP 2000, and MSEP 2011), Judicial Plan and Judicial Plan 2011, and the Administrative Law Judges & Legal Advisors Plan who are applying for retirement on January 1, 2021 or after.

2. What is the reason for the rules on bona fide termination and rehire of employees by the same employer?

The IRS has specific rules around when a member of a qualified governmental pension plan may receive a retirement benefit. Specifically, the IRS requires an employee to have a bona fide termination with the employer before receiving a retirement benefit. MOSERS has conferred with its outside tax counsel and confirmed that without a separation from service, there can be federal tax penalties for both the member and MOSERS. The new Board Rules are designed to follow the IRS guidelines for separation of service and prevent such tax penalties from being levied against our retirees and the System.

3. What does the IRS require for a bona fide termination to have occurred?

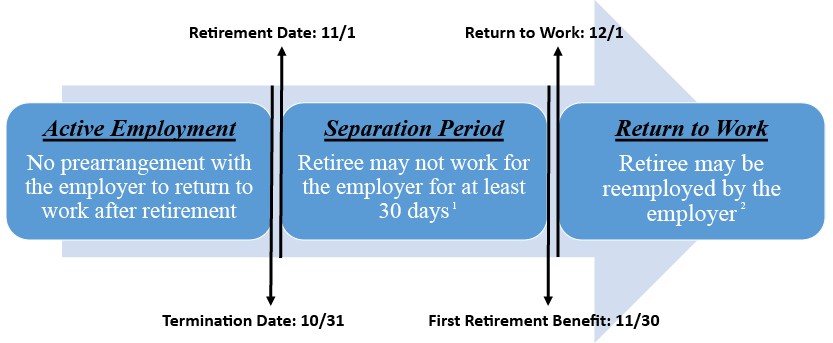

A bona fide termination has always been a requirement for retirement benefits to be effective. While the IRS has not stated the number of days that constitute a bona fide termination, they have issued guidelines detailing certain requirements. For a bona fide termination of employment to have occurred, there must be no prearrangement, written or oral, for reemployment prior to the member's termination date. To help ensure compliance, MOSERS requires members to observe a 30-day separation of service period before reemployment in any capacity can occur with the same employer.

Retiring members must certify on their retirement application, under penalty of fraud, that no prearrangement for employment exists.

4. What is meant by "reemployment in any capacity with the same employer"?

Reemployment in any capacity includes but is not limited to employment in a benefit-eligible, non-benefit-eligible, part-time, or temporary position; or as a contract employee, leased employee, or as an independent contractor.

Employer means the State of Missouri or any other MOSERS employer covered by Chapters 104, 287, or 476, RSMo. (See MOSERS-covered employers)

5. Will the rules be applied retroactively?

MOSERS will administer its Board Rules prospectively (on a going-forward basis) for retirees applying for retirement after the effective date. No retroactive action will be taken by MOSERS. As previously stated, the IRS requirement for a bona fide termination is currently in effect.

6. What happens to existing returned retirees?

An existing returned retiree is subject to the IRS requirement of a bona fide termination from employment before receiving a retirement benefit. Should an IRS review of the retiree occur, a facts and circumstances review may be done and a final determination will be made by the IRS. Any payment deemed to be an in-service distribution may be subject to a 10% early distribution penalty by the IRS.

7. If the returning retiree returns to a non-benefit eligible position, which does not receive MOSERS benefits, is the rule still violated?

A retiree who returns to work with the same employer (as defined in #4), without the required separation of service period, would have a violation of the return to work limitation regardless of the type of position the retiree is returning to (see #4).

8. If an employee retires from MOSERS, can I hire them back in a position covered by MoDOT & Patrol Employees' Retirement Plan (MPERS), the Judicial Plan, or Administrative Law Judges and Legal Advisors Plan (ALJ)?

Yes, if there is no prearrangement and the 30 day separation of service period is observed. The key to this requirement is whether the employee/employer relationship has been severed, not what retirement plan the member participates in. The reason for this is because all employees covered by MPERS, the Judicial Plan, and the ALJ Plan are considered to be part of the same employer - e.g. the State of Missouri. If reemployment occurs in a benefit-eligible position, retirement benefits will stop.

9. What if the employee is an employee working for the Office of Administration? Can the employee be rehired in position with a different department with the State after retirement?

Yes, if there is no prearrangement and the 30-day separation of service period is observed. The reason for this is because all departments and branches of the State are considered to be part of the same employer - e.g. the State of Missouri. If reemployment occurs in a benefit-eligible position, retirement benefits will stop.

10. What if the employee is an employee working for Northwest Missouri State University? Can the employee be rehired in a position with another university covered by MOSERS?

Yes; however, since the employee is moving employment from one MOSERS-covered employer to employment with another MOSERS-covered employer, there must be no prearrangement and the 30-day separation-of-service period must be observed. If reemployment occurs in a benefit-eligible position, retirement benefits will stop.

11. Can an employer enter into a contract with an employee prior to their termination for employment after they retire (ex. Phased retirement program, early retirement incentive program, etc.)?

No. For a bona fide termination of employment to have occurred there must be no prearrangement, written or oral, for reemployment prior to the member's termination date. The employee can be rehired after the 30-day separation-of-service period. A retiree could enter into a contract after termination but the retiree could not be rehired prior to the expiration of the 30-day separation-of-service period. If reemployment occurs in a benefit-eligible position, retirement benefits will stop.

12. What is the corrective action?

If a member receives retirement benefits without a bona fide termination, then: (a) all further benefit payments shall cease; and (b) the member shall be required to repay to the System all retirement benefits received from the System plus applicable interest based on the assumed rate of return on the date of the member's retirement. Any amounts, including interest, not repaid by the member to the System shall be subject to collection from the member's future retirement benefits. In addition, any payment deemed to be an in-service distribution may be subject to a 10% early distribution penalty by the IRS.

The member's retirement shall be deemed null and void. The member can apply for retirement benefits at any time during the member's continued employment, but must have a bona fide termination of service and observe the 30-day separation-of-service period to receive retirement benefits.

Retiree Return to Work Examples

1 Employers may discuss reemployment with a retiree after termination but the retiree cannot be rehired prior to the expiration of the 30-day separation period.

2 After a bona fide termination and 30-day separation, retiree may return to work in a non-benefit-eligible position and also continue to receive MOSERS retirement payments.